RocketFin - Next Generation AI for B2B Credit Scoring and Risk Assessment

RocketFin is revolutionizing the way businesses assess credit risk in the B2B sector. By leveraging advanced AI technology, RocketFin automates the credit decision-making process, making it faster, more reliable, and inclusive. Traditional methods of evaluating credit risk are often outdated and cumbersome, leading to slow and biased decisions. With RocketFin, businesses can benefit from a streamlined approach that enhances efficiency and accuracy.

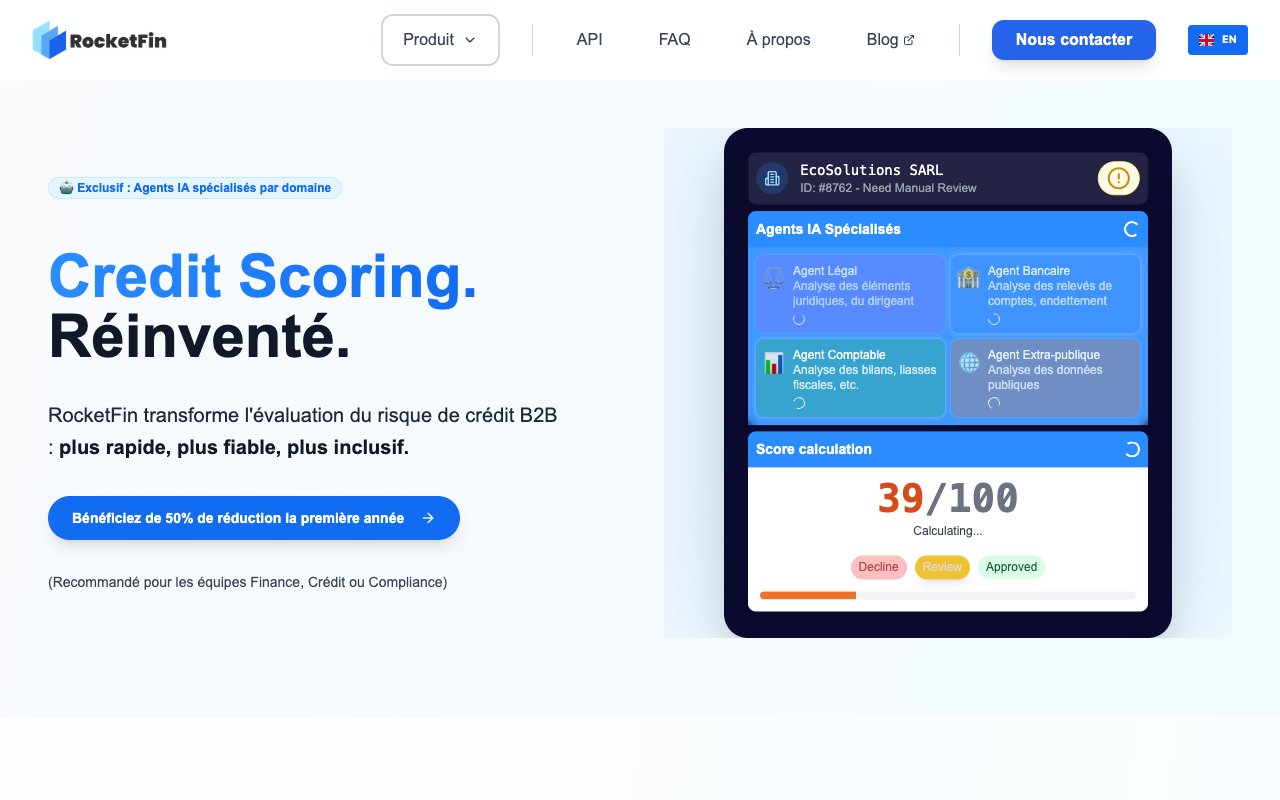

One of the standout features of RocketFin is its real-time scoring capability. This allows finance teams to make informed decisions based on up-to-date information, significantly reducing the time spent on manual processes. The platform offers specialized AI agents that analyze various aspects of a business, including legal elements, banking statements, and public data. This comprehensive analysis ensures that all relevant factors are considered, leading to better credit assessments.

The benefits of using RocketFin extend beyond just speed. The platform provides customizable thresholds and alerts, ensuring that businesses can tailor their scoring criteria to fit their specific needs. With dynamic and continuous evaluation, RocketFin’s scoring system adapts automatically to new data, providing a clear visualization of a client’s financial health. This is particularly valuable for B2B finance players, as it enables them to anticipate risks and make proactive decisions.

In conclusion, RocketFin offers a cutting-edge solution for credit scoring in the B2B landscape. By automating the process and utilizing AI technology, businesses can enhance their decision-making capabilities and improve their overall risk management strategies. Explore more about RocketFin and how it can transform your credit assessment processes by visiting RocketFin .